CAREFULLY CHOOSING SUPPLIERS – THE FOUNDATION OF PURCHASING STRATEGIES

In many cases, completely new sourcing aspects need to be considered for new projects. For example, aspects like sustainability and CO2 footprint management are becoming increasingly important in purchasing and are being demanded by vehicle manufacturers as well as by suppliers and sub-suppliers. This also impacts how the supply network is selected. The contract manufacturer must be very flexible when it comes to sourcing.

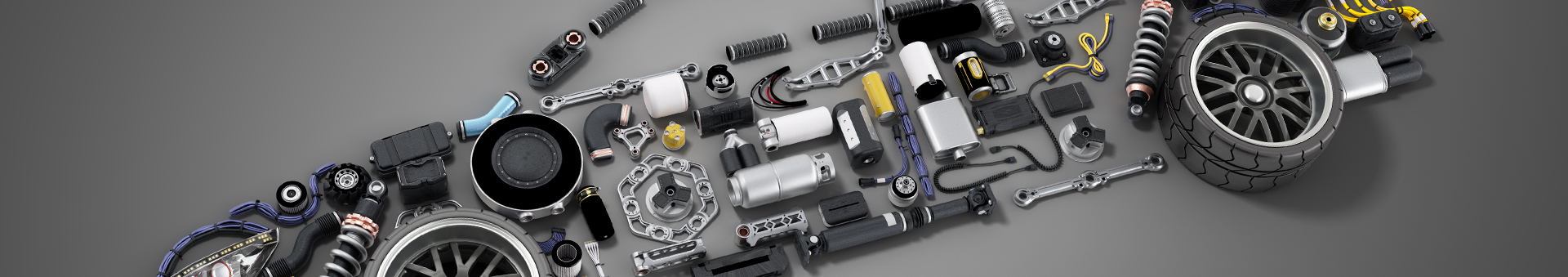

In addition, new projects often require cooperation with a new type of supplier, especially if there is a transition away from combustion engines towards e-mobility. This applies both to established vehicle manufacturers who are converting and renewing their product portfolio and even more so to new entrants to the automotive industry. Their e-car projects will not require suppliers for combustion engines, tanks and exhaust systems, but will require suppliers for e-motors and traction batteries.

NEW TECHNOLOGIES REQUIRE NEW SUPPLIERS

However, this change in suppliers extends not only to the drivetrain components, but also to chassis components. Due to the higher weight of electric vehicles, these components are exposed to different stresses than in conventional combustion vehicles and therefore must be newly procured.

In addition to the numerous control units of BEVs or hybrid vehicles, including the Electronic Drive Unit (EDU), there is also a high-voltage cable harness as well as a low-voltage cable harness. Moreover, regardless of the drive technology, all newer vehicles come with more and more software features which also need to be procured.

IT ALL STARTS WITH QUALITY

The most important key criteria in the selection of suppliers is the required quality. As a company with a global presence and operations, Magna only works with suppliers with a similar international presence. Globality is therefore another important criterion. This also applies to aspects of sustainability. For example, every part supplied by a supplier based in Mexico has a much higher CO2 footprint than if it is manufactured in a European plant with much shorter transport routes to the site of vehicle production. In addition to the sustainability aspect, transportation costs also factor into the final decision.

THE PLATFORM CONCEPT: FAVORABLE CONDITIONS FOR THE CONTRACT MANUFACTURER

Depending on the project, the contract manufacturer does not enjoy complete freedom in its choice of suppliers. Purchasing strategies must always be created in close consultation with the vehicle manufacturer, and in some cases are even specified by the latter. This can prove to be very advantageous, as the vehicle manufacturer can negotiate favorable conditions through the large quantities of components that are used in several vehicle model series – the carry-over parts. The contract manufacturer then also profits from these conditions.

When working on a new vehicle project with Magna in Graz as a development service provider, it is also part of the service to search for and negotiate with the suppliers in question and evaluate the overall package, consisting of component prices, discounts, one-off and logistics costs. The manufacturer placing the order can then follow this recommendation from a list of proposals with a corresponding order and an order recommendation. However, they can also decide in favor of another supplier from the list of proposals, for example, for their own strategic and political reasons.

ACTIVE SUPPLIER RISK MANAGEMENT – ACTING PROACTIVELY BEFORE A PROBLEM ARISES

Due to the close cooperation with suppliers, a manufacturing company is always dependent on them since the unexpected total disruption of a supplier could bring vehicle production to a standstill. It is therefore particularly important for a contract manufacturer to constantly monitor the reliability of its suppliers. This allows countermeasures to be taken in good time if risks are imminent.

The financial strength of the supplier is assessed at regular intervals as well as ESG criteria (Environmental, Social and Governance, i.e. environmental, social behavior and corporate ethics). The findings of these investigations are incorporated into an ongoing supplier assessment – and thus play an important role in future purchasing strategy decisions.

Of course, manufacturers always have the final say in these matters. However, it is advantageous for them if the contract manufacturer conducts their own risk management in purchasing. With all the tools for supplier assessment and with an existing reliable supplier base, a contract manufacturer has the strategic advantage over a company focused solely on manufacturing that lacks these tools.

FAVORABLE CONDITIONS IN THE INTEREST OF THE CLIENT

Contract manufacturers do not profit directly from favorably negotiated conditions – unless a risk-and-opportunity model is in place. As a rule, the purchased parts are passed on to the OEM. However, unit prices do play a role for the manufacturer when it comes to calculating the total manufacturing costs of the vehicle in question.

However, for the contract manufacturer, the total costs of a component over the entire life cycle of the respective vehicle can be relevant. This is called value over buy. Alongside the unit prices for the component in question, this includes not only the logistics costs, but also development costs or tooling costs. From an overall perspective, a supplier with a very favorable unit price could nevertheless perform unfavorably in terms of value over buy due to logistics or development costs, for example.

SE TEAM: EVALUATION DURING THE ENGINEERING PHASE

Purchasing strategies do not only activate whenever specific components need to be procured but are already represented in the SE (simultaneous engineering) team. This team, also called 'cloverleaf', consists of representatives from Engineering, Supplier Quality Assurance, Logistics and Purchasing. For each component, the team examines in advance whether it really needs to be redesigned and developed or whether it would be cheaper to use a part that is readily available on the market, thus saving on development costs and tool costs.

Ultimately, the decisive factor is how beneficial a new development is for the customer and the end customer who buys the vehicle. Even if the engineering department creates a particularly sophisticated functional module that would significantly increase the cost of the end product, if it does not provide the end customer with any significant additional benefits, it depends on the vehicle class whether this more expensive solution is used. This decision is always made in consultation with the customer. If the customer requests additional functions, the resulting costs are negotiated as part of the change management process.

ACTIVE MANAGEMENT OF THE SUPPLIER PORTFOLIO IN ONGOING PROJECTS

If a new vehicle project is acquired from a company with an already established history of cooperation, proven suppliers who have been well evaluated in previous projects are initially shortlisted. However, any prudent contract manufacturer will constantly re-examine the existing supplier base and analyze the market to identify new, even more attractive suppliers. This principle doesn’t apply to cases in which new technologies require new sourcing anyway.

The constant open exchange with existing suppliers also plays an important role here, because they also continue to develop. If a supplier expands its portfolio to include new products or if it changes its focus regarding drive types or mobility trends, it can become an interesting partner for projects in an area that it had not previously covered. It is therefore essential to have in-depth knowledge of the market and conducting constant market observation to be able to provide the ideal selection basis for new projects.

CHANGING SUPPLIERS IN ONGOING PROJECTS

The supplier for certain components can change during an ongoing series in some exceptional cases. For example, if the previous supplier is at risk of becoming unstable due to financial difficulties. In such cases, the contract manufacturer must take preventative action in good time – by sourcing a new supplier to avoid risking vehicle production bottlenecks due to delivery failures, for instance.

It is also possible to review the supplier base for environmental reasons or regarding the so-called Supply Chain Act: Can components also be sourced from a local supplier so that less environmentally damaging transportation is possible? Does the previous supplier use hazardous substances or disregard important health and safety regulations?

However, a change of supplier during series production is always a delicate matter and requires long preparation and changeover times – and not just in terms of production tools. A corresponding lead time must be built up in vehicle production. In cases with safety-relevant components, part of the vehicle testing may have to be repeated.

EXTERNAL CHALLENGES: A CASE OF FORCE MAJEURE?

Even a contract manufacturer with exceptional purchasing strategies is relatively powerless in the face of challenges arising from external, global (for example, political) events or situations. Neither the supplier nor the production plant can do anything about a delivery stop of important components due to war events or pandemics. Also, unforeseen cost increases due to legal measures or soaring raw material or energy prices will have to be passed on to the contract manufacturer, as well as to the vehicle manufacturer. However, the purchasing department will carry out detailed cost analyses and benchmark comparisons to check whether the supplier's price increases are plausible and justified. If necessary, negotiations need to be reopened. Any changes in efficiency on behalf of the supplier are also a reason to renegotiate since it is generally not possible to pass on the exact extent of price increases to the client.

NEW TOOLS IN THE AGE OF INDUSTRY 4.0

Increasingly comprehensive digitalization offers opportunities to optimize both quality and efficiency of suppliers through more intelligent production control – and thus to ultimately reduce the costs of purchasing supplier parts. As a contract manufacturer, Magna profits from supporting suppliers in such cost-cutting measures, through instruments such as joint material purchasing or the provision of materials, for example.

In the end, all available tools are needed to achieve ideal results in the SE team from the outset and during ongoing series production. Being able to make an attractive offer to the vehicle manufacturer is a joint effort on all fronts.

Nowadays, Purchasing has become a department that increasingly evaluates and processes data – from the proactive supplier evaluation, the supplier selection itself, to working as part of the SE team in the project phase. Therefore, it relies on a network of systems that are most advantageous when being properly aligned with the working methods.

Stay connected with Inside Automotive!

We want to hear from you

Send us your questions, thoughts and inquiries or engage in the conversation on social media.

Related Stories

The Future of UI/UX Concept Visualization in the Automotive Industry: Innovations, Challenges, and Perspectives

Inside Automotive

UI/UX Design in Vehicle Development: How Design Shapes the User Experience

Inside Automotive

Market and Industry in Transition: How a Competent Partner Can Help Navigate Challenges in the Automotive Industry

Inside Automotive

Successfully Starting Series Production: Start-up Management in the Automotive Industry

Inside Automotive

Stay connected

You can stay connected with Magna News and Stories through email alerts sent to your inbox in real time.

.tmb-widescreen.webp?sfvrsn=8d57edff_1)